Blog

Fee-based onramp routing is costing you business

The most popular method for connecting users to onramps is deeply flawed — for a number of reasons. Here's why you should be considering alternative solutions.

My user has multiple onramps available. I should automatically point them towards the one that offers the lowest fees.

On the surface, this is a great decision. It makes perfect sense to want to provide your users with the lowest fees, as it results in more crypto received.

In practice, though? The transactions fail the majority of the time. And, even when they do succeed, the fees aren’t what you think.

What’s up with onramp fees?

The top providers offer some very attractive percentages when it comes to their fees. Dig a little deeper, however, and you’ll find out that these figures only refer to the onramp’s cut.

In other words, there are other costs involved. Our recent report identified the culprits as conversion rates, bid-ask spreads and network fees.

These aren’t negligible, either: when we conducted a $200 USD → BTC swap on six different onramps, the crypto received varied by over 10% from solution to solution.

In short: price quotes are getting spoofed across the board. If lowering fees is your utmost priority, benchmark based on the crypto your users receive.

The critical flaw in fee-based routing

Let’s assume that fee-based routing does work as intended, and that it consistently matches your users with the cheapest onramp.

There’s still an excellent chance that this onramp isn’t actually able to complete the transaction. Owing to a range of factors, a given onramp is a poor fit for the majority of users. For instance, some solutions might be optimized only to cater to a limited European audience, while others may only be appropriate for a handful of Asian countries.

Even then, that’s a gross oversimplification. Transaction success hinges on over 70 factors, ranging from user location to their desired currency pair. With so much happening under the hood, transaction failure is basically a coin flip away when you don’t optimize your routing practices.

A strategy based on finding the lowest fees alone fails to take these factors into account — which is why you should consider the alternatives.

Which onramp routing strategy is best?

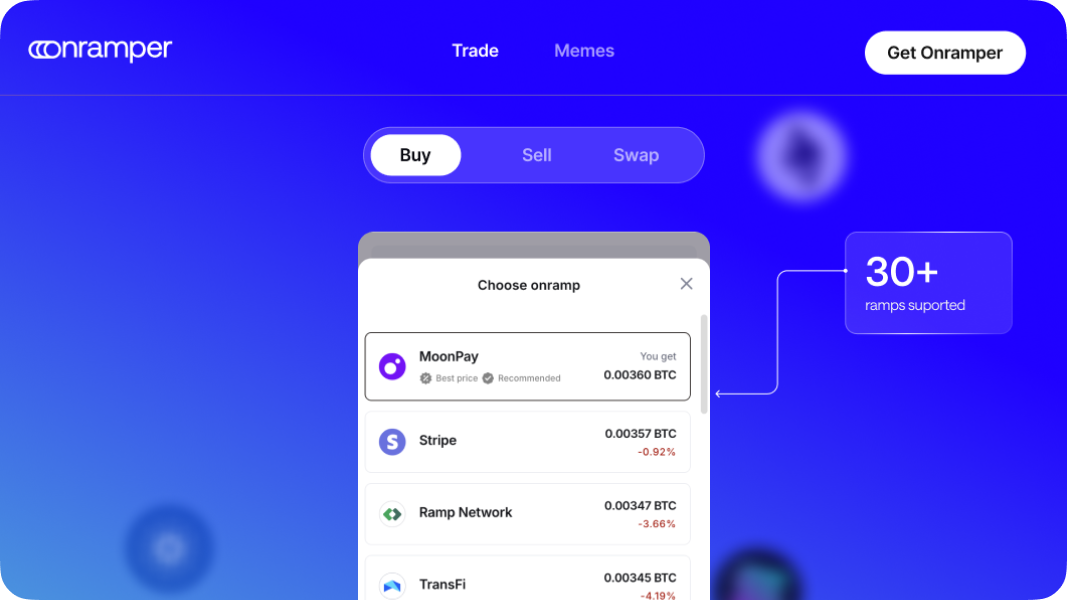

No method reigns supreme, though a handful stand out. In all cases, the more onramps available, the more effective your routing efforts can be:

- It means more options to point your users towards

- It means more sources to learn from and improve on the data collected

We advise that players in this space aim to aggregate at least 10-15 onramps. That way, you’ll have ample global coverage and plenty of fallback options should a single onramp go offline.

With that in mind, here are our top picks, based on over two years of onramping insights.

Success-based routing

This logic does what it says on the tin: it routes your users towards the onramp most likely to ensure transaction success.

Our engine does so by learning from previous transactions and matching users with onramps that have been successful for historical users matching their profile.

Return-user routing

Success-based routing is fantastic out of the box, but you’ll soon want to stack more precise routing rules on top of it to really push for high success rates.

Return-user routing doesn’t just make an informed decision based on industry-wide data. It actually recognizes the user if they’ve completed a transaction previously, and recommends the onramp they used.

Low-KYC routing

Know Your Customer regulations are in place for good reason — but the flows designed to identify users can be cumbersome and, often, needlessly complex.

With low-KYC routing, users are matched with the route that requires as little verification as possible for their desired transaction. This method is particularly effective, as KYC complications majorly impact success rates.

Route smarter with Onramper

Since our inception, we’ve made it our mission to create an onramping machine living up to the promise of the crypto revolution. That means a consistent fiat → crypto experience for all users, regardless of their location.

Time and again, success-based routing (paired with other logic) delivers phenomenal results for our clients and their users. Whether you’re just starting out and prefer a fully managed solution, or you’ve already got an in-house aggregator and want to expand your offering, our suite has you covered.

→ Download our latest success rate case study

Other articles

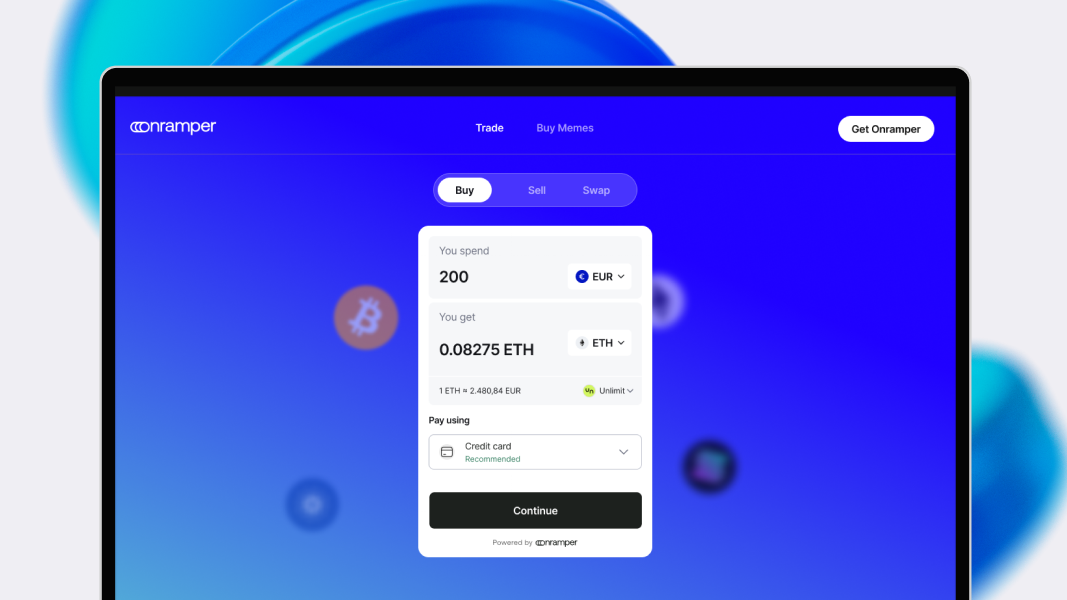

Introducing our new crypto trading portal: the easiest way to buy, sell and swap

Buying crypto should be simple. Selling and swapping should feel just as easy. That’s why we’re leveling up the Onramper experience to make this a reality.

Meet our new crypto portal, the world’s simplest all-in-one trading platform. It brings buying, selling and swapping together in one place with the best available fees and full global coverage.

One place for everything

It’s easy for trading flows to feel scattered, with buying, swapping and selling all living in different places. We set out to fix that..

Our portal brings everything together so the entire journey stays clear and straightforward from start to finish. You can now:

- Buy crypto with 170+ payment methods

- Sell back to fiat

- Swap 100K+ assets across 50+ networks, with 11+ liquidity providers

All from one clean, intuitive interface.

Always the best fees, automatically

Crypto pricing moves fast, with fees constantly shifting based on payment method, geography, KYC requirements and liquidity. Our smart routing engine tracks all of it in real time and selects the best provider automatically.

We do the work, and you get the best fees with the highest chance of transaction success.

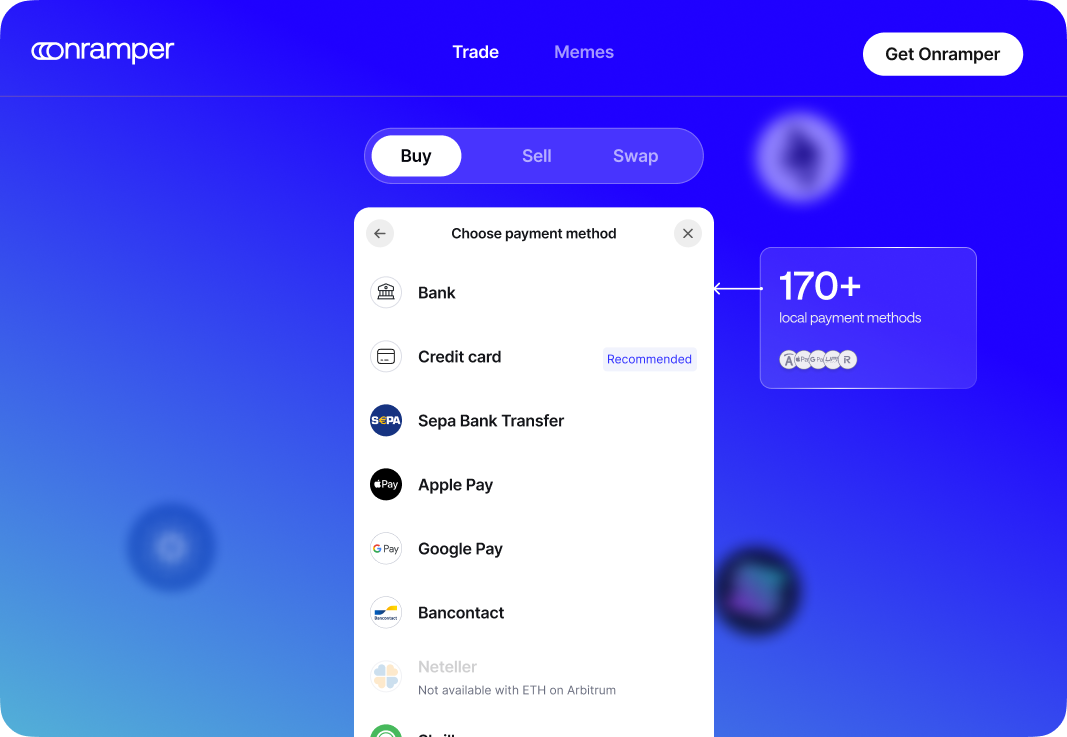

Any payment method. Any user.

A global product requires global payment coverage. The new portal supports 175+ payment methods including cards, Apple Pay, Google Pay, bank transfers, regional options and alternative methods found in high-growth markets.

Since payment preferences vary by region, the interface automatically highlights the options that perform best in your area. This keeps the experience fast, familiar and easy for any user, anywhere.

Buy any memecoin on Solana with MoonGate

The rise of memecoins has changed what’s expected from a trading experience. People want speed, simplicity and access to the long tail of new tokens.

By integrating MoonGate directly into the portal, we deliver exactly that. You can:

- Sign in with Google or Apple to generate a wallet instantly

- Discover trending Solana tokens

- Buy or swap into any memecoin in seconds

No separate setup and no manual wallet creation. Just instant access.

This is just the beginning

This portal isn’t an add-on. It’s a dedicated page built around a single widget that supports every trade type in one unified experience. And it’s only the first version.

We’ll continue adding new features that streamline the entire trading journey. From smarter token discovery to personalized payment suggestions, our goal is to create the smoothest crypto trading experience possible.

Try the full experience here: https://onramper.webflow.io/buy

Axiom Partners with Onramper to Power Seamless DeFi Trading

With Onramper, Axiom users around the world can top up BNB and SOL with 130+ payment methods including Apple Pay and Venmo.

AMSTERDAM, December 4, 2025 – Onramper, the world’s leading fiat-to-crypto onramp aggregator, announced a partnership with Axiom, the Y Combinator-backed Solana-based trading platform, to deliver one of the fastest and most seamless trading experiences in DeFi. Through this integration, Axiom users worldwide can instantly top up BNB and SOL using more than 130 payment methods, including Apple Pay, Google Pay, Venmo, debit and credit cards, and localized options across 190 countries.

Axiom has quickly become one of the top trading platforms in the Solana ecosystem, offering access to memecoins, perpetuals, and yield strategies. In October 2025, the platform made history as the fastest crypto company to reach $300 million in revenue. Through its collaboration with Onramper, Axiom is offering users a simple, fast way to onboard and begin trading on Solana.

“Our job is to simplify the way users move from fiat into crypto,” said Thijs Maas, CEO of Onramper. “By offering a wide range of trusted, localized payment options, we ensure that users can onboard quickly and compliantly. We’re thrilled to support Axiom as they scale the next generation of DeFi on Solana.”

Onramper’s network supports more than 130 payment methods and enables crypto purchases across 190+ countries. Its routing engine recommends the best available conversion in real-time, maximizing the chances of a successful transaction and helping users receive the most crypto for their fiat.

“We’re delivering an onchain trading experience that is fast, global, and intuitive,” said Henry Zhang, Co-Founder and CEO of Axiom. “Integrating Onramper strengthens that experience by giving users a reliable way to move from fiat to crypto and access onchain liquidity.”

Onramper continues to lead the onramp aggregation space, connecting more than 30 global fiat gateways and supporting over 2,000 digital assets, driving greater accessibility and inclusivity across Web3.

To learn more, please visit onramper.com and axiom.trade.

About Onramper

Onramper is the leading fiat-to-crypto payments aggregator, providing a turnkey API-based solution for dynamically routing fiat-to-crypto onramp flows based on algorithms optimizing for conversion, fees and payment methods. Onramper’s platform allows users of clients to buy 2000+ digital assets, in over 190 countries with over 130 payment methods in 120 currencies, with advanced routing options and unified analytics. The company is based in the Netherlands. To learn more about Onramper, visit www.onramper.com.

About Axiom

Axiom is a trading platform designed to be the only application you need to trade onchain. It offers a suite of integrations that allow users to trade the hottest assets, all in one place.

For media enquiries, contact:

Zengo Enters Partnership with Onramper to Unlock Global Crypto Access

Collaboration will power 130+ payment methods across LATAM, SEA, Africa, and more, simplifying fiat-to-crypto onboarding worldwide

AMSTERDAM, Nov. 5, 2025 /PRNewswire/ -- Onramper, the world’s leading fiat-to-crypto onramp aggregator, today announced a partnership with Zengo Wallet, the most secure self-custodial crypto wallet trusted by millions, to expand global payment access for users.

Through this collaboration, Zengo users can now buy crypto through Onramper at the most competitive fees available, starting at just 2% for Zengo Pro users. The integration supports more than 130 local payment methods, streamlining purchases across key markets in Latin America, Southeast Asia, and Africa.

The partnership also enables a seamless onboarding flow for first-time users, while returning users are automatically directed back to their preferred payment providers–delivering a faster, more intuitive, and personalized experience.

“Access to crypto should not depend on where you live or which payment method you use,” said Thijs Maas, CEO of Onramper. “By partnering with Zengo, we’re removing the barriers that have limited participation in Web3, especially in regions with high demand but limited infrastructure. Together, we are making it easier for anyone, anywhere, to enter the crypto economy safely and efficiently.”

This partnership reinforces Zengo’s mission to make crypto ownership simple and secure, particularly in emerging markets where local payment coverage is key to adoption. By integrating Onramper’s technology, Zengo users will enjoy smoother onboarding, lower fees, and a more consistent purchasing experience, whether they are new or returning customers.

“At Zengo, our goal is to provide secure and low-cost access to any type of digital asset for individuals and businesses,” said Ouriel Ohayon, co-founder and CEO of Zengo. “Through our partnership with Onramper, we’re expanding global access to crypto and stablecoins with a faster, cheaper, and wider selection of payment methods anywhere, anytime.”

Integrating local payment methods across multiple regions has long been a complex and resource-heavy process for crypto platforms. Onramper’s aggregation technology removes this barrier by unifying both global and local onramps within a single API, giving partners instant access to the world’s most comprehensive fiat-to-crypto infrastructure.

Onramper continues to lead the onramp aggregation space, connecting more than 30 global fiat gateways and supporting over 2,000 digital assets in more than 190 countries, driving greater accessibility and inclusivity across Web3.

To learn more, please visit onramper.com and zengo.com.

About Onramper

Onramper is the leading fiat-to-crypto payments aggregator, providing a turnkey API-based solution for dynamically routing fiat-to-crypto onramp flows based on algorithms optimizing for conversion, fees and payment methods. Onramper’s platform allows users of clients to buy 2000+ digital assets, in over 190 countries with over 130 payment methods in 120 currencies, with advanced routing options and unified analytics. The company is based in the Netherlands. To learn more about Onramper, visit www.onramper.com.

About Zengo Wallet

Zengo Wallet is the most secure self-custodial crypto wallet, trusted by over 2 million individuals and businesses in 180+ countries. Since 2018, no Zengo wallet has ever been hacked. Zengo Pro includes advanced features like Bitcoin Vaults, an inheritance-style feature, and now, heavily discounted fees on purchase. Powered by MPC cryptography, Zengo has no seed phrase vulnerability and is backed by Insight Partners, Tether, and other leading investors.

For media enquiries, contact: